Stop Order

A stop order, also called a stop-loss order, is an order to trade a security when it has reached above or below a specified price. When the price is met, the stop order is triggered and changed to a market order.

- In a buy stop order, a stop price is set above the current market price. It could be used by investors in many scenarios. For example, investor A has observed an increase in XYZ stock and believes it is a good trading opportunity. However, she is not sure if this is a long-term upward trend. Therefore, she places a buy stop order with a stop price of $30 when XYZ stock is trading at $27. The order will only be filled at the market price if XYZ stock rises to $30 or above.

- A buy stop order could also be used by short sellers to stop potential losses. For example, investor B opened a short position in XYZ stock at a price of $27, expecting the stock price to fall. He could place a buy stop order of XYZ stock with a stop price above $27 to limit his losses from unexpected price increase.

- In a sell stop order, a stop price is set below the current market price. It could be used by investors to stop losses or to lock in profits. [AE1] [TW2] Investor C bought stock XYZ at $22 share but wishes to risk no more than $5 dollars per share, so they place at $17 share level of XYZ. If the market falls to $17 dollars, the sell stop order is triggered and the investors stock is sold at the next available market price.

- Another example, investor D bought XYZ stock at $22. He wants to lock in a profit of about $2 per share, so he places a sell stop order with a stop price of $24. If the market rise to $24 dollars, the sell stop order is triggered and the stock is sold.

To sum up:

A stop order is triggered at the stop price and filled as a market order. The stop price is set above (buy stop) or below (sell stop) the market price.

With a stop order, investors can seize trading opportunities without having to monitor the market closely. Investors can use stop orders to lock in profits or stop losses. Please note: it is possible that a stop order may fill at a price much different from the stop price, especially in a volatile market. If you want to limit your trading price, a stop order may not be the best choice.

Tips:

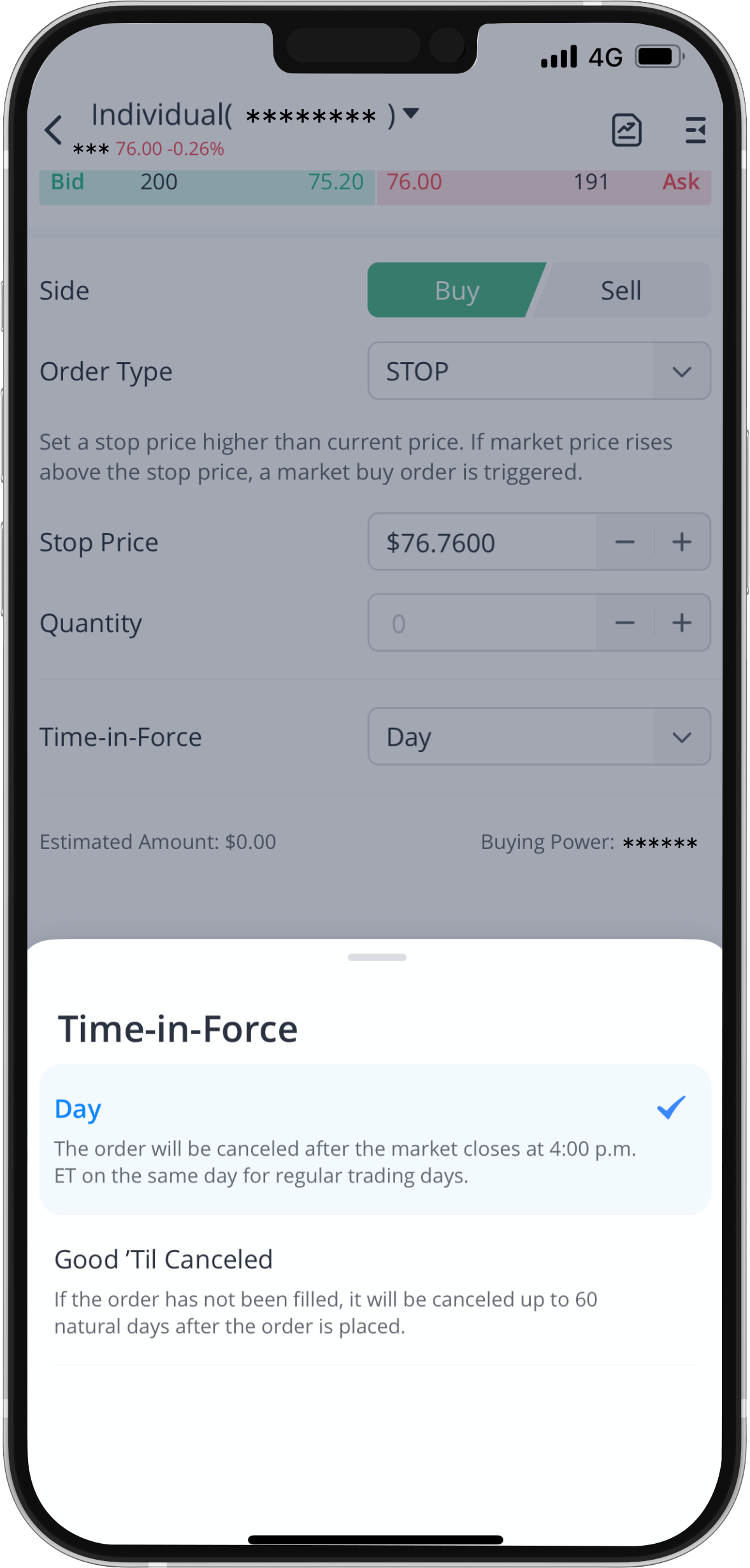

- On Webull, we support placing stop orders in both market and extended hours in stocks trading.

- You can choose a Day order if you only want your order to last for a day. If you want your order to last longer, use a Good ‘Till Canceled order, which will last for 60 days (including weekends and holidays).

Reference:

Buy Stop Order Definition (investopedia.com)